Rethink Technology Research a research and analyst company focusing on IoT, video and wireless, say that operators must get ready for Multicast ABR, which is in its infancy with services only just beginning – or risk losing out on a new revenue stream.

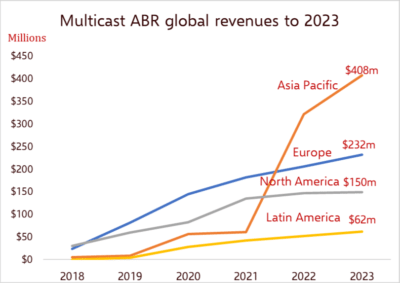

Transcasting and Multicast-ABR will create product revenues of $852.2 million per annum by 2023 for the vendors which can position themselves as leaders in this market.

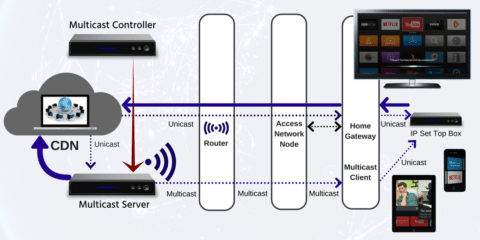

Transcasting was coined as a term about 5 years ago – it means taking an Adaptive Bit Rate OTT video stream, and shoving it out to the world at large, through an existing multicast network – so that all video arrives at the same time.

Once the problem of how to do this was solved it was just a matter of finding a route to market and enticing operators with the promise of new revenues. In 2018 that market is now poised to take off, with Europe at the heart of the revolution, as the US hesitates, and Asia Pacific runs a full two years behind.

This market will become ever more important as “live” events such as major sports go to market direct to consumers and require “linear concurrency” in the delivered product.

The technology relies on making changes to the manifest of existing unicast ABR feed and turning them into something ready to be distributed through existing multicast router networks. A handful of businesses – notably Comcast, and two major French operators – have been using this in stealth for a while now.

These multicast streams then have to be turned back into ABR streams for consumption, and this is done either at the network edge, just before the home, or in the home gateway of the broadband network. The market winners will be those who can offer software across a multiplicity of Home Gateway types, based on a wide variety of chips, and provide performance that consumers are simply unaware of – except that all the video is virtually real time.

Now satellite operators are on the case, and recently Eutelsat announced a similar method of transmission, using DTH broadcast instead of routed multicast streams – so Telcos, Cableco and DTH suppliers have all found yet another way to compete across the board.

Multicast ABR is ready for prime time and will:

• Reduce Live traffic on CDNs

• Reduce operator delivery fees to CDNs

• Make it easy to reach 4 or 5 million viewers simultaneously

• Allow operators to consolidate head ends and cut software costs

• Fit in with a cloud based video ecosystem, end to end

• Enable programmatic advertising on all forms of video

• Facilitate new eSports, Sports and Live Music business models

Effectively it will allow operators to fight back against video customer churn, with a new revenue stream gained from partnering Live OTT video events as they go direct to the consumer.

Revenues will grow fastest over the next two years in Europe, but the US already has a considerable investment in Multicast ABR, and this will be followed up eventually by other cable and IPTV operations. DTH, although not strictly a standardized Multicast-ABR marketplace, will emerge late in all four territories – where satellite broadcasts are used to send encapsulated live ABR broadcasts within the DTH signals.

By 2023 a handful of Asia Pacific markets will drive potential revenues there of $408 million in license fees for Transcast servers and Multicast Clients, after a late start into this technology, with Europe making the early running by then on revenues of $232 million, and the US on some $150 million.

During the compilation of this report we held discussions the wider industry and the following M-ABR vendors; Broadpeak, Cisco, Nokia and Oregan Networks, to tap into their experience and market understanding, and we would like to offer them our thanks for this.

About Rethink

Rethink is a thought leader in quadruple play and emerging wireless and IoT technologies. It offers consulting, advisory services, research papers, plus three weekly research services; Wireless Watch, a major influence among wireless operators and equipment makers, along with its forecasting arm RAN Research; Faultline, which tracks disruption in the video ecosystem, and OTT video, along with its forecasting arm Rethink TV; Riot which focuses on enterprise disruption from the combination of AI/IoT and cloud, along with its forecasting arm Riot Research.