Renesas Electronics Corporation (“Renesas”, TSE: 6723), a premier supplier of advanced semiconductor solutions, announced that it has resolved at the Meeting of Board of Directors held on September 11, 2018 to reach an agreement with Integrated Device Technology, Inc (“IDT”, NASDAQ: IDTI), whereby IDT will become a wholly-owned subsidiary of Renesas. Following approval by IDT shareholders and the relevant regulatory authorities, the acquisition is expected to be completed within the first half of the fiscal year ending December 31, 2019. The transaction is a friendly acquisition which has been unanimously approved by the board of directors of IDT.

1. Purpose of the Acquisition

Renesas has been executing its growth strategy to thrive as a world-leading embedded solution provider in the rapidly changing global semiconductor market. As the pillars of its growth strategy, Renesas is accelerating its focus on the automotive segment, where Renesas has maintained a key global position over many years and further growth is anticipated in areas such as autonomous driving and EV/HEV; industrial and infrastructure segments, which are expected to advance with Industry 4.0 and 5G (fifth-generation) wireless communications, as well as the fast-growing IoT segment.

In order to achieve this growth strategy, Renesas is working to expand its analog solution lineup and to strengthen its kit solution offerings that combine its world-leading microcontrollers (MCUs), system-on-chips (SoCs) and analog products. In this context, Renesas already completed the acquisition of Intersil Corporation (“Intersil”), a U.S.-based analog semiconductor supplier, in February 2017.

With the Intersil acquisition, Renesas enhanced its lineup of power management-related analog devices as well as its ability to deliver kit solutions to customers combining Renesas’ MCUs/SoCs and analog products from the former Intersil. At the same time, Renesas expanded its sales and design-ins outside of Japan and strengthened global management capabilities by absorbing the former Intersil’s experienced management team into the Renesas Group.

Renesas has made the decision to acquire IDT, a U.S.-based analog semiconductor supplier, to contribute further towards the growth strategy. IDT is a global enterprise engaged in the development, production, sale, and provision of services related to analog semiconductor products such as mixed-signal semiconductor solutions particularly for markets related to the data economy such as data center and communication infrastructure that require big-data processing. IDT has annual sales of approximately US$843 million (approximately 92.7 billion yen at an exchange rate of 110 yen to the dollar, FY2018) and an operating profit margin of over 25 percent (non-GAAP basis).

The strategic benefits this transaction is expected to bring is as follows:

(1) Complementary products expand Renesas’ solution offerings:

The acquisition will provide Renesas with access to a vast array of robust analog mixed-signal capabilities in embedded systems, including RF, high performance timing, memory interface, real-time interconnect, optical interconnect, wireless power and smart sensors. The combination of these product lines with Renesas’ advanced MCUs and SoCs and power management ICs enables Renesas to offer an integrated solution that supports the increasing demand of high data processing performance. The enriched solution offerings will bring optimal systems from external sensors through analog front end to processors and interfaces.

(2) Expands business growth opportunities:

IDT’s analog mixed-signal products for data sensing, storage and interconnect are key devices that support the growth of data economy. Acquisition of these products enables Renesas to extend its reach to fast-growing data economy-related applications including data center and communication infrastructure, and strengthens its presence in the industrial and automotive segments.

Welcoming IDT as part of the Renesas Group after the Intersil acquisition completed in 2017 is therefore seen as an effective measure to further enhance Renesas’ competitiveness in fields where Renesas is focusing its efforts to strengthen the company’s position as a global leader.

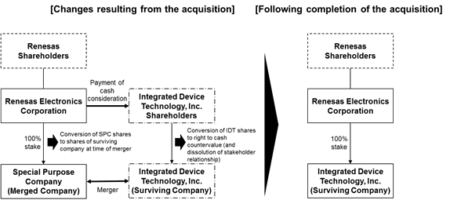

2. Acquisition Method

The acquisition will be implemented as follows. For the purpose of the acquisition, Renesas will establish a wholly-owned subsidiary (“acquisition subsidiary”) in Delaware, United States that will then merge with IDT (in a reverse triangular merger). The surviving company following the merger will be IDT. Cash will be issued for IDT’s shares as consideration for the merger, and the shares of the acquisition subsidiary owned by Renesas will be converted into outstanding shares in the surviving company, making the surviving company a wholly-owned subsidiary of Renesas. The acquisition will take effect following approval by IDT shareholders and the relevant governmental authorities, and the fulfilment of the other customary closing conditions pertaining to merger agreements. Under the merger agreement concluded between the parties for the purpose of implementing the acquisition, Renesas guarantees the fulfillment of obligations by the acquisition subsidiary.

For the purpose of the acquisition IDT shares are to be acquired at a price of US$49.00 per share, for a total equity value of approximately US$6.7 billion (approximately ¥733.0 billion at an exchange rate of 110 yen to the dollar). Current cash reserves in addition to the proceeds from bank loan with major banks in the amount of approximately ¥679.0 billion are expected to be sufficient to cover the purchase price, therefore Renesas does not intend to raise equity finance including issuance of new shares for this transaction.

3. Schematic Diagram of the Acquisition

4. Overview of IDT (Surviving Company)

Integrated Device Technology, Inc.

| (1) | Name | Integrated Device Technology, Inc. (NASDAQ: IDTI) | |||||

|---|---|---|---|---|---|---|---|

| (2) | Address | 6024 Silver Creek Valley Road, San Jose, CA 95138 | |||||

| (3) | Name and title of representative director | Gregory L. Waters, President & CEO | |||||

| (4) | Type of business | Development, manufacturing and sale of analog integrated circuits including mixed-signal solutions | |||||

| (5) | Capital | US$ 2,752,914 thousand | |||||

| (6) | Established | May, 1980 | |||||

| (7) | Major shareholders and their ownership ratios | BlackRock Fund Advisors The Vanguard Group, Inc. Columbia Management Investment Advisors, LLC SSgA Funds Management, Inc. T. Rowe Price Associates, Inc. |

8.40% 7.82% 4.24% 3.43% 3.26% |

||||

| (8) | Ties between Renesas and IDT | Capital ties | There are no relevant capital ties between Renesas and IDT. Further, there are no relevant capital ties between persons or companies related to Renesas and persons or companies related to IDT. | ||||

| Personal ties | There are no relevant personal ties between Renesas and IDT. Further, there are no relevant personal ties between persons or companies related to Renesas and persons or companies related to IDT. | ||||||

| Transactional ties | There are no relevant transactional ties between Renesas and IDT. Further, there are no relevant transactional ties between persons or companies related to Renesas and persons or companies related to IDT. | ||||||

| (9) | Consolidated business performance and consolidated financial status of IDT over the most recent three years | ||||||

| Accounting period | FY2016 | FY2017 | FY2018 | ||||

| Consolidated net assets (millions of US$) | 676.7 | 773.7 | 645.4 | ||||

| Consolidated total assets (millions of US$) | 1,099.2 | 1,183.6 | 1,310.5 | ||||

| Consolidated net assets per share (US$) | 4.58 | 5.63 | 4.87 | ||||

| Consolidated sales (millions of US$) | 697.4 | 728.2 | 842.8 | ||||

| Consolidated operating profit (millions of US$) | 136.6 | 110.3 | 110.9 | ||||

| Consolidated current net profit (millions of US$) | 194.7 | 110.5 | -12.1 | ||||

| Consolidated current net profit per share (US$) | 1.32 | 0.79 | -0.09 | ||||

| Dividends per share (US$) | - | - | - | ||||

(Note): Renesas is also acquiring the following eight companies as consolidated subsidiaries (specified subsidiaries) of Integrated Device Technology, Inc.: IDT Bermuda Ltd., IDT Canada, Inc., IDT Europe GmbH, Integrated Device Technology Malaysia SDN.BHD., IDT Singapore Ptd. Ltd., GigOptix (Israel) Ltd., GigPeak, Inc. and ZMD America LLC. Detailed information of each subsidiary will be provided once available.

5. Number of Shares to Be Acquired, Acquisition Price, and Share Ownership Before and After Acquisition

| (1) | Shares owned before transfer | 0 share (Number of shares with voting right: 0 share) (Ownership percentage: 0.0%) |

|---|---|---|

| (2) | Number of shares to be acquired | 135,840,094 shares (Note) (Number of shares with voting right: 135,840,094shares) (Percentage of outstanding shares: 100.0%) |

| (3) | Acquisition price | US$6.7 billion (approximately ¥733.0 billion at an exchange rate of 110 yen to the dollar) Advisory fee, etc. (estimated amount): Approx. US$10 million |

| (4) | Shares owned after transfer | 135,840,094 shares (Note) (Number of shares with voting right: 135,840,094 shares) (Ownership percentage: 100.0%) |

(Note) Based on the number of shares on a fully-diluted basis as of September 11, 2018 (reflecting dilutions, etc., that occurred following the stock-related compensation from the said acquisition.) Above figures have been rounded off to the closest whole number.

6. Schedule

| (1) | Renesas Board approval | September 11, 2018 |

|---|---|---|

| (2) | IDT Board approval | August 30, 2018 (PDT) |

| (3) | Conclusion of merger agreement | September 11, 2018 |

| (4) | IDT General Shareholders approval of the merger agreement | Fourth quarter of CY2018 or first quarter of CY2019 (expected) |

| (5) | Effective date of merger | Within first half of the fiscal year ending December 31, 2019 |

(Note) The conclusion of the transaction is subject to regulatory approvals and other customary closing conditions in the U.S and other countries.

7. Future Outlook

As a result of this acquisition IDT will become a consolidated subsidiary of Renesas. The impact on the consolidated performance of the Renesas Group will be disclosed in a timely manner as the acquisition proceeds.

About Renesas Electronics Corporation

Renesas Electronics Corporation (TSE: 6723) delivers trusted embedded design innovation with complete semiconductor solutions that enable billions of connected, intelligent devices to enhance the way people work and live—securely and safely. A global leader in microcontrollers, analog, power and SoC products and integrated platforms, Renesas provides the expertise, quality, and comprehensive solutions for a broad range of Automotive, Industrial, Home Electronics, Office Automation and Information Communication Technology applications to help shape a limitless future. Learn more at renesas.com.