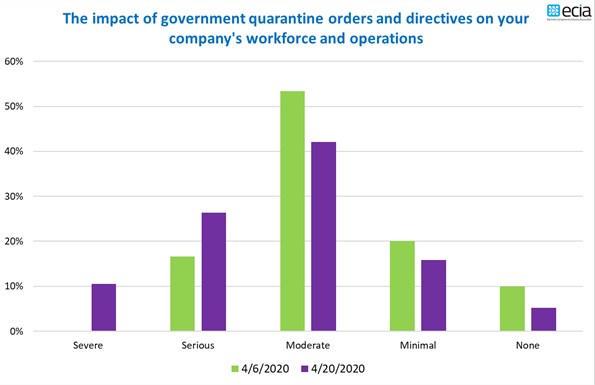

ECIA’s Chief Analyst Dale Ford has posted the results of the 6th survey of members regarding their response to the Coronavirus / COVID-19 pandemic. This crisis has reached every corner of the world and significantly disrupted markets and supply chains in every country. (See Figure below) The extreme uncertainty and volatility associated with this crisis has created a need for visibility on how it is impacting the electronic components industry and the supply chain. In order to provide important visibility, ECIA began conducting surveys of member manufacturing and distributor companies at the start of February to gain an understanding of this ever-evolving situation. ECIA has published survey results on a bi-weekly basis to provide continuous updates to our members.

This most recent survey was conducted between Monday, April 13th and Monday, April 20th. Between the most recent survey and the previous survey that ended April 6th the number of confirmed cases worldwide has grown by over 1.1 million people and deaths due to COVID-19 nearly doubled. Pressure to start easing quarantine orders is growing as a staggering number of workers have lost their jobs and unemployment claims have smashed records as the economic impact of the pandemic sweeps around the world.

The survey ended April 20th reflects a significant renewal in concern regarding supply chain impacts and end-market destruction due to COVID-19. This growing pessimism by survey respondents is broad-based across component categories, market segments and stages of the supply chain. While concerns related to raw material supply disruption declined notably, the number of respondents seeing a serious or severe impact on the electronic components production and end-market losses jumped by 12% and 11% respectively between the previous and most recent survey. Expectation regarding the loss of end-market demand grew the greatest in the consumer electronics segment as those anticipating a decline jumping to 50% of respondents. The Automotive and Industrial Electronics markets continuing to represent the segments of greatest concern with expectations of a decline growing to 62% and 60% respectively. Despite expectations for weak end-market demand, the confidence in order backlog remains quite strong across the board.

To read the complete Survey Synopsis, please go to www.ecianow.org.